If you ask most people what makes a successful growth investor, they will talk about IQ, financial modeling, or the ability to spot the “next Amazon” before anyone else.

They are wrong.

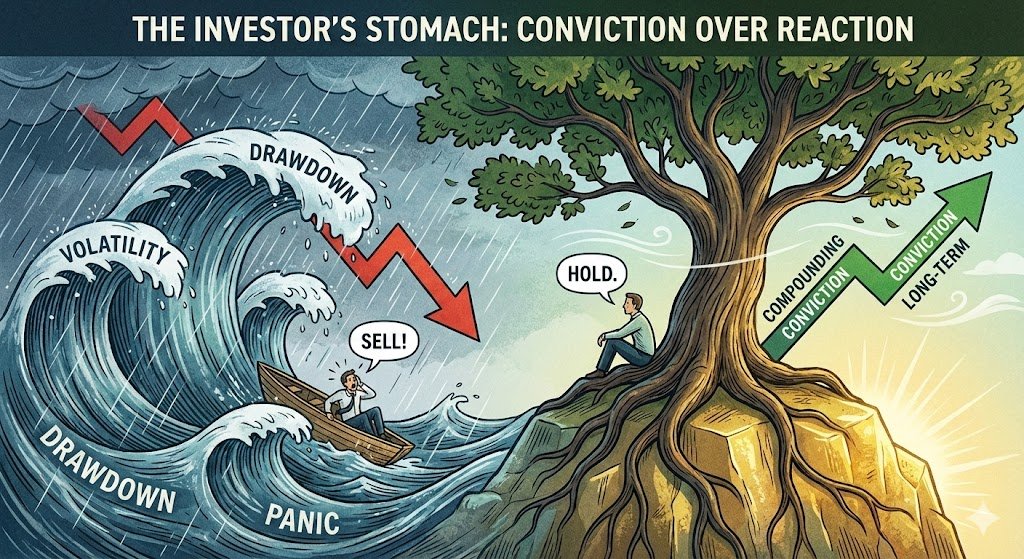

After decades in the market, I can tell you that the single most important factor for long-term success isn’t your brain—it’s your stomach.

The Price of Admission

Growth stocks are capable of life-changing returns, but they demand a steep price of admission: Volatility.

Look at the history of the greatest winners of the last 20 years. Every single one of them suffered massive drawdowns.

- Amazon lost over 90% of its value during the Dot-com crash.

- NVIDIA has seen multiple drops exceeding 50%.

- Netflix has been “left for dead” half a dozen times.

If you panicked and sold during those red years, your analysis of the company’s future didn’t matter. You locked in a loss and missed the rebound.

Conviction Over Reaction

The hardest thing to do in investing is absolutely nothing. When the market is bleeding and headlines scream “Recession,” your instinct is to flee.

But long-term wealth is built by holding through the pain. You must have the conviction to let the magic of compounding work uninterrupted.

The Bottom Line: You don’t need to find 50 winning stocks. You just need to find a few great ones and, most importantly, never interrupt them unnecessarily.

Stop checking your portfolio every day. Zoom out. If the business thesis hasn’t changed, neither should your position.